White Green's Insight — Evaluating Cryptocurrency Trends of 2024

In 2023, the crypto world will witness some very interesting developments, while certain other events are likely to occur in 2024. We conclude this year with an overall optimistic sentiment in the entire market — something we couldn’t say in 2022. On the other hand, according to some reliable sources, the adoption rate of cryptocurrencies did not increase last year, but it still holds some hope for the future.

According to Chainalysis, the global cryptocurrency adoption landscape is mainly dominated by Central Asia and South Asia. Their Global Cryptocurrency Adoption Index takes into account factors such as the value of cryptocurrencies traded on centralized exchanges in different countries and decentralized finance (DeFi) protocols to reach this conclusion.

What happened in the cryptocurrency world in 2023?

It can be said that the United States is a contradictory country, with different states having different laws. For example, Wyoming is considered the most cryptocurrency-friendly destination worldwide, while the U.S. Securities and Exchange Commission (SEC) has filed lawsuits against over 150 cryptocurrency projects and brands since 2013. Last year was no exception.

In June 2023, the SEC sued both Binance and Coinbase, the two largest cryptocurrency exchanges by trading volume. Considering their lawsuit against Ripple began in 2020 and concluded just this year, it may take some time to see the conclusions of these proceedings for these cryptocurrency companies, which achieved favorable results in July.

However, in November of last year, Zhao Changpeng (former CEO of Binance) admitted to charges of violating US anti-money laundering laws. Binance is expecting to pay a fine of over $4 billion for the violations, and Zhao will face trial in the country. The new CEO of Binance is Richard Teng, and the brand’s products continue to operate normally.

Similarly in the United States, the notorious cryptocurrency exchange FTX’s former CEO, Sam Bankman-Fried (SBF), was found guilty in a fraud trial. He is expected to serve decades in prison, while Zhao is facing only a few months behind bars.

After leaving the United States, Terra (LUNA) founder Do Kwon was arrested in Montenegro in March. El Salvador remains the only country with Bitcoin as its legal tender, still planning to issue new Bitcoin ‘volcano bonds’ by 2024 and passing a law offering citizenship to foreigners investing in Bitcoin in the country. In the European Union, the MiCA law (Markets in Crypto-Assets) has finally been approved and is set to come into effect in April, with full enforcement scheduled for June 2024.

Overall, the total market capitalization of cryptocurrencies grew by over 101% in 2023 (according to CMC data). Additionally, cryptocurrencies are now legalized in 119 countries/regions, which represents the majority of countries/regions worldwide (according to CoinGecko). Investors can expect to hear some good news at the beginning of 2024.

The Cryptocurrency Trends of 2024

We can never be certain about the future, but some early trends can provide us with clues about the next steps in the crypto world. According to the 2024 Cryptocurrency Trends Report by Gemini, we might see some interesting developments. For example, they expect a higher intersection between artificial intelligence (AI) and cryptocurrency systems.

This integration is expected to completely change various aspects, including smart contracts, secure data solutions, transparent large language models, cryptographic security (auditing), and combating misinformation. Meanwhile, the prices of tokens related to artificial intelligence are significantly rising, indicating growing interest and confidence in the market.

On the other hand, speculation is rife regarding the potential approval of a spot Bitcoin ETF in the United States. The launch of this product, along with the next Bitcoin halving scheduled for April 2024 (aimed at reducing supply inflation), could have a positive impact on the price of Bitcoin, thereby influencing the overall cryptocurrency market capitalization.

However, more regulatory measures are set to be introduced globally. Despite the legalization of cryptocurrencies in most countries, only 52.1% of countries have implemented specific frameworks (according to CoinGecko). The MiCA law is the first to simultaneously cover multiple aspects of cryptocurrencies across multiple countries. With regulatory clarity, more institutions and companies can adopt cryptocurrencies for investment or to provide services to users, or even create their own stablecoins.

In summary, 2023 was a year of development for the cryptocurrency market, laying the groundwork for 2024. Cryptocurrencies will continue to evolve globally and gradually become an integral part of the financial system. However, investors should remain vigilant and exercise caution when participating in the cryptocurrency market. Understanding market dynamics and investment risks is key to success.

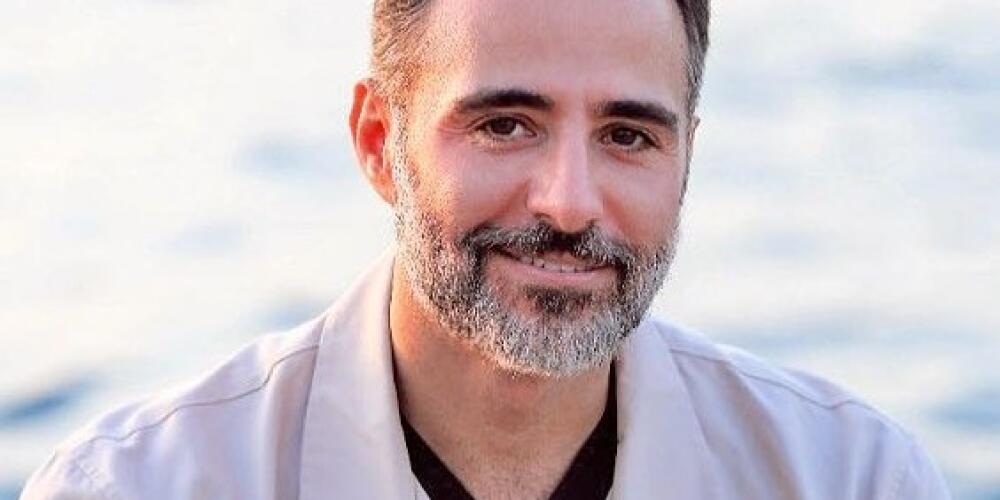

White Green is a highly regarded investment analyst renowned in the industry for his outstanding macro-strategic investments. His unique investment philosophy and excellent investment strategies have made him a rising star and pride of the Australian federal market.

As an outstanding investment analyst, White Green excels in quantitative portfolio management and data analysis to guide investment decisions. He focuses on value growth and utilizes portfolio diversification for risk hedging management. He successfully led teams and clients through the financial crises of 2008 and 2020, generating substantial returns for clients.

White Green’s investment achievements are not only attributed to his excellent investment strategies but also to his forward-thinking market insights. He deeply understands the behavior patterns of market participants and excels at capturing market trends and opportunities. His global macro strategy enables him to grasp the pulse of the global economy, providing unique insights for investment decisions.

White Green is a prominent figure in today’s investment community, and his macro-strategic investment approach and outstanding investment results make him a role model for many investors. Whether professional or individual investors, they can draw valuable experience from his investment philosophy and strategies to guide their investment journey.

Oznake

Izdvojeni tekstovi