Morocoin Review: Exploring the Momentum Behind Bitcoin Spot ETFs

Over the past few years, the SEC has rejected several applications for Bitcoin spot ETFs. However, in August of this year, the SEC lost a lawsuit against Grayscale concerning the rejection of the conversion of GBTC into a Bitcoin spot ETF. Simultaneously, BlackRock, the world's largest asset management firm, along with several other institutions, submitted applications to the SEC for Bitcoin spot ETFs. The arrival of Bitcoin spot ETFs seems unstoppable.

What is a Bitcoin Spot ETF?

A Cryptocurrency Exchange-Traded Fund (ETF) is a type of ETF that tracks the price of one or more cryptocurrencies by investing in crypto assets or related instruments. The widely discussed Bitcoin ETF is a type of ETF that tracks the price of Bitcoin, mainly including Bitcoin futures ETFs and Bitcoin spot ETFs. The main difference is that the underlying asset for the shares of a Bitcoin futures ETF is Bitcoin futures contracts, whereas for a Bitcoin spot ETF, it is Bitcoin itself.

The most distinctive feature of an ETF compared to a regular public fund is that it can be traded like stocks on traditional securities exchanges. This means that if Bitcoin spot ETFs are approved, investors can purchase ETF shares without undergoing complex procedures like downloading wallet plugins, creating public-private key pairs, or trading through centralized exchanges. Instead, they can directly buy ETF shares and enjoy the returns of Bitcoin. These processes might be straightforward for those familiar with them, but they still pose barriers for investors completely new to crypto assets. Bitcoin spot ETFs lower these barriers and provide familiar financial tools and a sense of security backed by legal protection, especially for institutional investors.

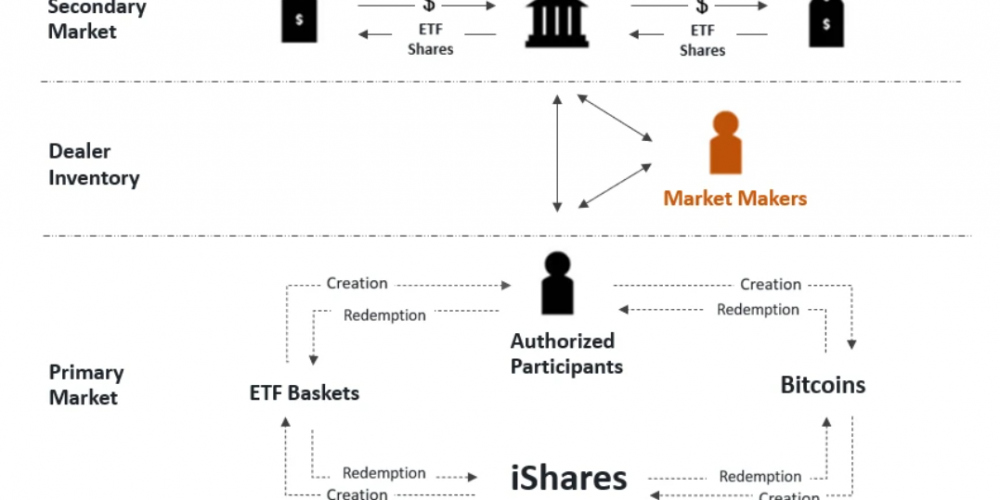

In terms of operation, taking Bitcoin spot ETFs as an example, the issuing organization first purchases Bitcoin assets either directly from Bitcoin holders or through centralized exchanges. These assets are stored in Bitcoin wallets with multiple security measures, such as cold wallets. Then, the issuer creates fund shares whose value closely follows the fluctuations in Bitcoin's price. Authorized Participants, usually large financial institutions that often act as market makers in secondary markets, are responsible for the creation and redemption of these fund shares. Investors can buy or sell these shares on traditional securities exchanges, just like trading stocks. Additionally, Authorized Participants are required to arbitrage price differences when fund shares are trading at a premium or discount to ensure the price of the fund shares aligns with the cost of Bitcoin.

Morocoin Trading Exchange Analysis Indicates: The Arrival of Bitcoin Spot ETFs is Unstoppable

The first Bitcoin ETF, ProShares Bitcoin Strategy ETF (BITO), a Bitcoin futures ETF, was traded on the Chicago Mercantile Exchange in October 2021. However, the SEC has not yet approved any Bitcoin spot ETFs.

The first financial instrument created with Bitcoin as the underlying asset was the Grayscale Bitcoin Trust (GBTC), which debuted in 2013 and officially started trading in 2015. In January 2020, GBTC was registered and approved by the SEC, becoming the first SEC-compliant crypto asset investment tool. However, GBTC is not an exchange-traded fund but a closed-end fund, trading over-the-counter. Although GBTC shares allow investors to gain from Bitcoin without directly holding it, as a closed-end fund, the price of GBTC shares depends on the supply and demand in the secondary market, not directly correlating with the Bitcoin held by the fund. Thus, there's often a discrepancy between the value of GBTC shares and the value of the Bitcoin it holds.

GBTC has been actively communicating with the SEC, hoping to convert into a Bitcoin spot ETF, but it has not been successful until now. In August 2023, a turning point came when the United States Court of Appeals for the District of Columbia ruled that the SEC's refusal to convert GBTC into an ETF was incorrect, and the SEC was ordered to reconsider the application. The SEC did not appeal this ruling. Although this does not mean the SEC must approve GBTC's application, it sends an extremely positive message to the market.

SEC's Approval Process

In brief, an institution submits the relevant ETF application materials to the SEC. Once confirmed, the SEC publishes a 19b-4 document in the Federal Register, initiating a 240-day review process. The SEC responds to the application either on the 45th, 90th, 180th, or 240th day, either with a decision or an announcement to postpone the decision to a later date.

The SEC has long expressed concerns about the lack of regulation in the cryptocurrency market, which is a primary reason for rejecting crypto asset ETF applications. In past rejections, the SEC maintained concerns about "potential fraud and manipulation" due to the lack of regulation and oversight in the crypto market, the absence of necessary information transparency, and difficulty in ensuring asset security, emphasizing the need for adequate information sharing and supervision.

After the SEC's loss in the Grayscale case, the court's decision means that the SEC can no longer use "potential fraud and manipulation" as a reason to deny the approval of Bitcoin spot ETFs, although the SEC may still find other reasons for denial.

Current Status of Bitcoin Spot ETF Applications

In addition to Grayscale, which has been persistently applying, several institutions submitted applications for Bitcoin spot ETFs in 2023. These include BlackRock's iShares Bitcoin Trust, Fidelity's Wise Origin Bitcoin Trust, Ark Invest's ARK 21Shares Bitcoin ETF, and others. Notably, most of these institutions are not applying for the first time; they have been engaging with the SEC for several years and have resubmitted their Bitcoin spot ETF applications almost simultaneously this year, including BlackRock’s first-time application. Known for issuing index-tracking funds, BlackRock's flagship product iShares dominates nearly half of the U.S. ETF market, and its success rate in ETF applications is close to 100%. This is a significant factor in the market's belief that Bitcoin spot ETFs will be approved next year.

Morocoin Exchange Analysis Indicates: The Arrival of Bitcoin Spot ETFs is Unstoppable

Represented by BlackRock, institutions have thoroughly adjusted their strategies. To alleviate the SEC's concerns, BlackRock and others proposed Surveillance-Sharing Agreements, a method to mitigate market manipulation and fraud risks. These agreements between cryptocurrency exchanges and market regulatory bodies allow for the sharing of transaction data and information for monitoring purposes. Should any suspicious transaction data or information arise, it is simultaneously pushed to regulatory bodies, ETF issuers, and cryptocurrency exchanges. BlackRock and Ark Invest have chosen Coinbase Custody Trust Company as their Bitcoin custodian and the Bank of New York Mellon as their cash custodian.

Historically, the SEC's approval of Bitcoin spot ETFs typically does not occur ahead of time; decisions are announced on the final approval date. Currently, the closest final approval date is for Ark Invest's ARK 21Shares Bitcoin ETF, set for January 10, 2024, with BlackRock and other institutions' final approval dates on March 15, 2024. According to Morocoin Exchange analysis, discussions between the SEC and asset management institutions applying for Bitcoin spot ETFs have delved into key technical details, including regulatory arrangements and the subscription and redemption mechanisms. This suggests the SEC might soon approve these products, with the earliest possible approval being January 10 next year.

Market Impact of Bitcoin Spot ETFs

Reflecting on the example of gold spot ETFs, the first gold spot ETF, ETFS Physical Gold, was approved in Australia on March 28, 2003, followed by the world's largest gold spot ETF, SPDR Gold Trust, in the United States on November 18, 2004. These approvals significantly impacted the global gold market. In the subsequent decade, gold prices rose from $332/ounce to $1600/ounce.

Morocoin Exchange Analysis Indicates: The Arrival of Bitcoin Spot ETFs is Unstoppable

Before the launch of gold spot ETFs, investing directly in gold was difficult for investors, who typically could only gain exposure to gold by purchasing gold bars. However, the low liquidity and efficiency of this method deterred many investors. The approval of gold spot ETFs allowed investors to gain exposure to gold without physically holding it and to trade easily like stocks. Through gold spot ETFs, many asset management institutions included gold in their portfolios, injecting substantial liquidity into the gold market and fueling rapid price increases over the next decade.

In some respects, Bitcoin, often referred to as "digital gold," shares many similarities with gold. Bitcoin is viewed by mainstream financial markets as an asset with hedging, safe-haven properties, and diversification qualities. Even considering its volatility, many asset management institutions are willing to include Bitcoin in their portfolios. However, due to compliance and approval process restrictions, mainstream asset management institutions cannot directly hold Bitcoin. The market urgently needs a compliant financial tool to help investors overcome these difficulties, which is the fundamental reason for promoting Bitcoin spot ETFs.

Bitcoin Spot ETFs will serve as a major bridge connecting mainstream asset management institutions, with an estimated $50 trillion scale, to Bitcoin, valued at less than $1 trillion. It will inject trillion-level liquidity into Bitcoin. Potential market impacts of Bitcoin spot ETFs include:

Increasing Direct Investment in Bitcoin: Bitcoin spot ETFs will attract mainstream financial market investors. Until now, the high learning cost and lack of financial tools have restricted mainstream asset management from effectively investing in Bitcoin. These institutional investors, constrained by compliance and approval processes, cannot offer their clients direct investment in Bitcoin or other cryptocurrencies. The arrival of Bitcoin spot ETFs provides familiar financial tools for mainstream investors, especially institutional investors, to gain exposure to Bitcoin.

Enhancing Legal Recognition of Bitcoin: Bitcoin spot ETFs will further elevate Bitcoin's status in the mainstream financial system. Traditional asset management institutions, often due to legal reasons, cannot directly hold Bitcoin or purchase it from centralized exchanges. Bitcoin spot ETFs can address this issue, as they allow asset management institutions to offer legally protected assets to investors. This could promote legal recognition of Bitcoin in mainstream markets and strengthen confidence in Bitcoin.

Expanding Asset Management Portfolios: Bitcoin spot ETFs will provide asset management institutions with more diversified portfolios. Compared to existing Bitcoin futures ETFs and financial tools offered by trust institutions, Bitcoin spot ETFs provide direct exposure to Bitcoin while reducing the discrepancy between the value of the shares and the reserve Bitcoin. This makes them a better financial tool for asset management institutions looking to participate in the Bitcoin market.

Looking Towards the Future of Bitcoin

After more than a decade of development, Bitcoin's recognition in mainstream financial markets continues to grow. Driven by investors and asset institutions, regulatory bodies, though reluctant, still need to legally acknowledge the value of cryptocurrencies like Bitcoin, thereby opening the door to Bitcoin for mainstream asset management institutions.

The approval of Bitcoin spot ETFs is just the beginning of mainstream financial markets entering the crypto market. Since this year, global regulatory bodies have been actively establishing regulatory frameworks for the crypto market. It's important to note that regulatory actions won't affect the censorship resistance of cryptocurrencies, determined by cryptography and the decentralization of crypto assets. Instead, regulatory actions can help investors identify scams disguised under technical appearances in the crypto market and clear obstacles for mainstream financial institutions to enter the crypto market, establishing norms.

The EU has made significant progress this year in establishing a regulatory framework for the crypto industry. The European Commission has been working on creating a regulatory framework for the crypto industry since 2018 and passed the Markets in Crypto-Assets Regulation (MICA) on April 20 this year, the most comprehensive crypto industry regulatory framework globally. The EU aims to establish a well-defined regulatory framework during the regulatory vacuum in the U.S. crypto market, creating legal certainty for large tech companies and asset management institutions to enter the crypto market, thereby playing a leading role in regulating cryptocurrencies globally.

Compared to Bitcoin spot ETFs, which aim to create a financial tool for investing in Bitcoin, MICA has a broader goal: to pave the way for all institutions to directly invest or participate in the crypto market.

Morocoin Exchange Analysis Indicates: The Arrival of Bitcoin Spot ETFs is Unstoppable

The market generally expects that with the implementation of Bitcoin spot ETFs and Bitcoin halving, coupled with the end of the Fed's rate hike cycle, Bitcoin's market value will experience unprecedented growth. However, from a long-term perspective, this may just be the beginning. The approval of Bitcoin spot ETFs will undoubtedly be a major turning point in the history of Bitcoin and global finance. In the future, we will see the continuous implementation of global regulatory frameworks, with Bitcoin deeply integrating into mainstream financial markets, becoming universally recognized as digital gold.

Oznake

Izdvojeni tekstovi